Quarterly Reports Due October 31

If you held a 2020 license at any time during the 3rd quarter 2020, you MUST submit your LE-21 Quarterly Report form by October 31, 2020. The report covers the period from July 1 through September 30. Reports filed after this date will be assessed a $50 fine.

Filing quarterly reports using our online system is cheaper than filing paper forms. If needed, all paper forms can still be found on our website, including all daily forms.

Please make sure to provide copies of daily forms for progressive bingo (LE-34a), progressive pull tabs (LE-31a), and progressive raffles (LE-34c) with your submission. The progressive bingo forms should be updated after each bingo occasion and the pull tab and raffle forms should be updated regularly.

If you have any questions or concerns, contact Lisa Marty at lisa.marty@coloradosos.gov.

Thanks to Online Filers

To the almost 85% of all filers who have shifted to online filing, let us just say a HUGE thank you, especially those who have converted during the pandemic. Our challenges in processing mail during this uncertain time (we are only in the office once a week to receive and process mail) have been greatly alleviated by your move to online filing, and we are additionally thankful to those who made this recent shift. To those still waiting to transition, please remember that the fees for online filing of quarterlies are cheaper than those for paper filing AND your filing is not being held up by waiting for the mail to be delivered to our office. As always, our team stands ready If you need any assistance with online filing. Just give us a call or drop us a line – we are more than happy to assist you in taking advantage of this filing method.

2020 Bingo-Raffle Licenses

If you plan to conduct charitable gaming activities in 2020, you can apply for your annual license at any time during 2020 via the online or paper application form (please allow 7-10 working days processing time). This applies to both new licenses and renewals. Licenses can be printed directly from the summary page if you apply online (once your filing is accepted) or e-mailed to the organizational e-mail address, if provided, on the paper form. To minimize unnecessary delays, please review your application before submitting. Sign into your account if you wish to apply online or visit our forms page to download the paper license application. New applicants can start the process from here. Please contact Program Manager Shannon Bee by email at shannon.bee@coloradosos.gov with any questions.

Bingo/Raffle Advisory Board

The Colorado Bingo-Raffle Advisory Board makes recommendations to the Secretary of State's office in its regulation of the charitable gaming sector. All members of the public are encouraged to attend and contribute to this important dialogue. The last meeting of the Board was held on March 6, 2019. The next meeting is scheduled for:

When: TBD

Where: TBD

Though there are no current meetings scheduled, if you have any topics that you’d like addressed by the Board, please reach out to them to have your idea noted for discussion. Their contact information can be found here.

If you have any questions, please feel free to send us an email at public.licensing@coloradosos.gov.

We would also like to remind current members of the Board that there is a statutory requirement that they complete yearly Board training. This training is available here under Bingo-Raffle Advisory Board training.

Bingo/Raffle Financial Reports.

Our office is committed to using our state-wide reach to provide timely and accurate data to the bingo/raffle community. We use the information you provide on quarterly reports to publish two informative datasets on our website.

- Aggregate revenue report: this report contains a "roll-up" of total revenue, expense, and profit data for charitable gaming in the state.

- Revenue by licensee: this report contains similar information broken down by individual bingo/raffle licensees. We began publishing this report in response to a request from our Bingo/Raffle Advisory Board.

Our website currently contains reports for calendar years 2013 through 2nd Quarter 2020. Reports are updated quarterly.

|

E-Filing a Bingo-Raffle License Renewal

Starting November 1, current Bingo-Raffle licensees can renew their licenses for 2021, as long as your 3rd quarter 2020 quarterly report has been filed. The Secretary of State's office encourages groups to file online. If renewing online, the licensee needs to access their online account and use the “renew” link on their account’s summary page. Please do not create a new account as these filings will need to be rejected and resubmitted through your already existing account.

When filing online, the system will only accept credit or debit cards; we do not have ACH or the ability to directly transfer funds from your accounts. The card, however, does not have to be linked directly to the bingo-raffle account. A personal card could be used (we do not retain any card information once the submission is made to our office), and then reimbursed from the bingo-raffle account (we will need adequate descriptions on the schedule A that the reimbursement was for a “loan” to repay the person using their personal card for this payment). Also, the group has the option of obtaining a prepaid card where it can be loaded with the appropriate amount to cover the payment.

Reminder: Mandatory Online Filing of Landlord Licenses

Since 2018, landlord license applications have been required to be submitted electronically. There is a training guide which is available on our website, here. Landlord licenses can be renewed any time after November 1 for the 2020 license year. If you have any questions or concerns regarding accessing the system, please contact Shannon Bee at 303 894 2200 x 6406. New landlord applicants can also access the system for the initial submission of the application and creation of your online account here.

Why I Cannot File an Electronic Quarterly Report

If your organization is trying to file your quarterly report electronically, but do not see one “available” for filing, the following may be the reason:

1. You cannot file your next quarter report if the previous quarter is still open. If your prior filing shows “reject”, you will need to resubmit the filing with the corrected information. We will need to approve this correction BEFORE your next quarter report will become available. If your filing has been rejected and resubmitted, your organization will receive a verification from our office, if and when the filing is approved. This will notify you that the next report is now available. Please be diligent and be sure your report has been approved by our office to mitigate timing issues and avoid possible late filings, which may cause fines to be instituted against your organization.

2. Please also be aware, as long as the rejected filing remains open, even if you file the next quarter by paper, our office will not be able to enter the paper report until the prior quarter has been re-filed and accepted electronically. If the rejected filing has not been accepted by the deadline of the next due quarterly, the organization will still receive a fine for a late filing as our office cannot override the rejected status of your prior filing.

If you do not see a quarterly available, or in a rejected status, it would mean your organization is not currently licensed to conduct games, and therefore, would not owe any quarterly (as you should not be conducting activity without a license). If you know your organization is currently licensed, but do not see any available or rejected status quarterlies, contact our office at 303 894 2200 and ask for assistance.

Quarterly Data Points

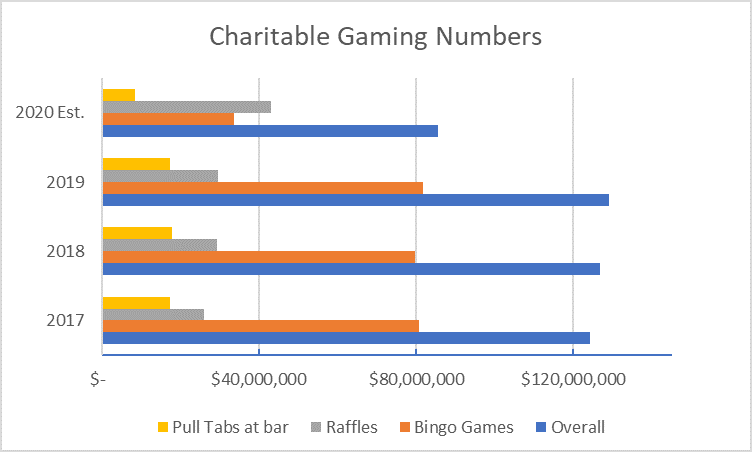

Charitable gaming activities around the state are slowly opening back up after the state shutdown. COVID-19 has had an effect on the activity reported in the second quarter as well as the overall amount wagered on charitable gaming in 2020. In the graph below, we are conservatively estimating the 1st and 2nd quarter activity will double to finish off the year.

The 1st and 2nd quarter reports always reflect revenue from large raffles which affect the overall raffle numbers. Raffles may continue a positive trend through 2020 as people find social distancing in this activity easier and presence isn’t always required. Some licensees are finding online sales, even with its many requirements, as an option to allow for social distancing and make money. Online sales information can be found on the Bingo and Raffles FAQs page here.

The bingo numbers in the graph include regular and progressive bingo and pull-tab games.

Games Manager Training

Your organization must have at least one certified Games Manager in order to run charitable games. We recommend licensees maintain more than one Games Manager. To support this, we offer in-person and online Games Manager training courses.

Sign up for the online eLearning course on our website.

All live classes have currently been cancelled due to COVID 19. Please go to this link for further updates on live classes.

Investigator Tips

Each quarter, we include a few tips from our Bingo/Raffle Investigators. They gather a lot of information in the field on where licensees have trouble complying with the law. By sharing this information, we hope that licensees can better serve their customers.

A MESSAGE FROM THE INVESTIGATORS:

We have received questions about withholding prize money from a progressive raffle from a person if they do not present their identification. The bottom line is you cannot.

There are provisions in the tax code to take out a backup withholding amount of 24% in the case that a player does not furnish their taxpayer identification number, (TIN), to the licensee. You can find that information in the IRS Publication 3079, Tax-Exempt Organizations and Gaming. There is a link to that publication on our website here. Rule 8.4.1(b)(5) states that “If the ticket purchaser selects the envelope containing the Jackpot Prize Card, the ticket purchaser wins the raffle prize amount…”. It does not provide for a house rule denying payment of a prize if the winner does not supply a TIN.

Likewise, a licensee cannot retain the jackpot prize at any time. If the jackpot prize has not been awarded, Rule 8.4.5 applies. Either the jackpot prize is: 1) Awarded; 2) Awarded to the first player whose ticket was drawn after it reached the jackpot limit; or 3) determination of a winner by drawing raffle tickets until a drawn winner selects the jackpot prize card. Rule 8.4.5(4) allows a licensee to award a jackpot in this same manner if the licensee has imposed a must-go limit less than the $15,000 limit.

You can access all bingo/raffle laws using our Bingo-Raffles Law Handbook. Please feel free to contact our office with any questions.

|

![]() The information on this page is archived and provided for reference purposes only. It may be outdated or no longer maintained.

The information on this page is archived and provided for reference purposes only. It may be outdated or no longer maintained.