Quarterly Reports Due July 31

If you held a 2019 license at any time during the 2nd quarter 2019, you MUST submit your LE-21 Quarterly Report form by July 31, 2019. The report covers the period from April 1 through June 30. Reports filed after this date will be assessed a $50 fine.

Please make sure you use our online system (note that the online quarterly is less expensive as fees are lower, than submitting with the paper form) or download and use the correct forms from our website, . PLEASE NOTE: There have been updates to the daily forms. Please be sure and access these from the above link on our "forms" page to ensure you always have the latest version.

Please make sure to provide copies of daily forms for progressive bingo (LE-34a), progressive pull tabs (LE-31a), and progressive raffles (LE-34c) with your submission. The progressive bingo forms should be updated after each bingo occasion and the pull tab and raffle forms should be updated regularly.

If you have any questions or concerns, contact Lisa Marty at lisa.marty@coloradosos.gov.

Thanks to Online Filers

To those of you who have already taken the opportunity to move to online filing – thank you! Early indicators from our postcard mailing a couple of months back show a positive trend in moving to online filing.

Remember – It’s cheaper, quicker and we’re here to help.

Please see the links in the “Postcard and Online Quarterly Filing” article of this newsletter to link to the tutorials for online filings. If you need any assistance, give us a call or drop us a line – we’re happy to help you take advantage of this filing method!

2019 Bingo-Raffle Licenses

If you plan to conduct charitable gaming activities in 2019, you can apply for your annual license at any time during 2019 via the online or paper application form (please allow 7-10 working days processing time). This applies to both new licenses and renewals. Licenses can be printed directly from the summary page if you apply online (once your filing is accepted) or e-mailed to the organizational e-mail address, if provided, on the paper form. To minimize unnecessary rejections, please review your application before submitting. Sign into your account if you wish to apply online or visit our forms page to download the paper license application. New applicants can start the process from here. Please contact Program Manager Shannon Bee by email at shannon.bee@coloradosos.gov with any questions.

Bingo/Raffle Advisory Board

The Colorado Bingo-Raffle Advisory Board makes recommendations to the Secretary of State's office in its regulation of the charitable gaming sector. All members of the public are encouraged to attend and contribute to this important dialogue. The last meeting of the Board was held on March 6, and the minutes will be posted once they are received by our office from the Board. The next meeting is scheduled for:

When: TBD

Where: TBD

If you have any questions, please feel free to send us an email at public.licensing@coloradosos.gov.

We would also like to remind current members of the Board that there is a statutory requirement that they complete yearly Board training. This training is available here under Bingo-Raffle Advisory Board training.

Bingo/Raffle Financial Reports.

Our office is committed to using our state-wide reach to provide timely and accurate data to the bingo/raffle community. We use the information you provide on quarterly reports to publish two informative datasets on our website.

- Aggregate revenue report: this report contains a "roll-up" of total revenue, expense, and profit data for charitable gaming in the state.

- Revenue by licensee: this report contains similar information broken down by individual bingo/raffle licensees. We began publishing this report in response to a request from our Bingo/Raffle Advisory Board.

Our website currently contains reports for calendar years 2013 through 1st Quarter 2019. Reports are updated quarterly.

|

Postcard and Online Quarterly Filing

As noted in the prior newsletter, we sent a postcard to licensees who have yet to adopt online filing of their quarterly reports/license applications, and encouraged uptake of online filing of these documents, including the benefits of filing this way. These included:

- Enjoy a .5% discounted filing fee for all filings submitted online

- Eliminate mail time – and the risk of being fined even though the “check’s in the mail”

- Once submitted to the queue online, and prior to the quarterly due date, you cannot be fined for late filing

- Less data entry required of our staff equals more time supporting you in other meaningful ways

- Online submission offers a preview feature to double and triple-check your submissions, providing a means to eliminate unnecessary rejects and re-submissions

- With a single –organization-wide email address, you can eliminate having to revert to paper upon the departure of staff

Our staff can assist your organization with creating this online account. Please call our office at 303-869-4910 to ask for assistance. We would be more than happy to assist you with this process. Additionally, we do have a power point tutorial for quarterly report filing located here and one for online submission of your license renewal located here. Again, please contact our office with any questions and we encourage your participation in submitting your documentation online.

Tips for Successfully Filing an Online Quarterly Report / E-Filing a Bingo-Raffle License Renewal

Here are some tips our office would like to provide to assist with successfully filing your quarterly report with our online system:

- When filing a quarterly where no raffle tickets were sold, no bingo games were conducted, and no pulltab tickets were sold, (but the organization is planning to conduct one of these activities or sell tickets still within the year), be sure to mark the quarterly as a “no activity”. No activity reports mean that you did not sell any raffle tickets, conduct a bingo game, or sell any pulltab tickets during the quarter for which you are filing. You still may have spent money from your bingo-raffle account or had expenses, and these items can still be entered on a “no activity” report.

- When completing the raffle prize descriptions on your quarterly, please be sure to give enough detail. As an example, if you gave away gift cards as raffle prizes, list the type of gift card or what the gift card was for. Another example would be if your prizes were “gift baskets”, you will need to include a list of what items were included in each gift basket given as a prize.

- Within the “check” column on the Schedule A: Distribution of Proceeds, if you make other types of payments from your Bingo-Raffle account other than checks, please make note of these in this column. As an example, you may list payments types such as check#, CC = Credit Card, DC=Debit Card or EFT/AFT =Electronic or Automatic Funds Transfer, for the different types of payments, if any of these additional types are done from the Bingo-Raffle account.

Quarterly Data Points: Interest in Progressive Pull Tabs at Bingo

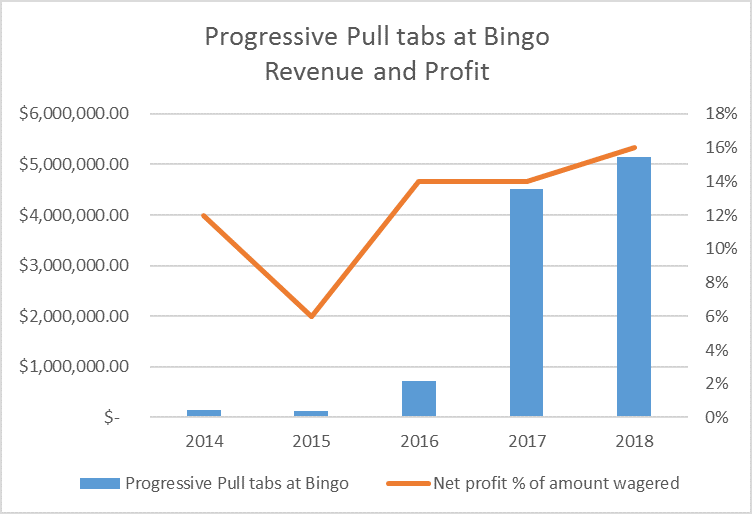

We are excited to share with everyone the continued interest that is being shown on Progressive Pull tabs at Bingo. As far back as 2014 Progressive Pull tabs at Bingo had an annual revenue of $152,310 with 12% net profit from amounts wagered. In 2018, however, the gross amount wagered on Progressive Pull tabs at Bingo increased to $5,149,578 with 16% net profit from the amounts wagered. The first quarter 2019 numbers reflect continued interest and profit in this game. The below graph shows the revenues for this game on the left and the percentage of profit on the right. It’s encouraging to see the renewed interest in this game.

The overall amount wagered at bingo occasions continues to remain around $80,000,000 with the percentage of net profit on the amounts wagered averaging nearly 13%.

The annual and quarterly numbers can be found on the aggregate report on our website under Charitable Gaming Financial Reports.

Games Manager Training

Your organization must have at least one certified Games Manager in order to run charitable games. We recommend licensees maintain more than one Games Manager. To support this, we offer in-person and online Games Manager training courses.

Sign up for the online eLearning course on our website.

For in-person classes, visit our Games Manager Training page and follow the instructions to sign up for a scheduled class.

The dates/times/places of upcoming Games Manager training classes follow:

Saturday, August 3, 2019 at 8:30 AM. BPO Elks 2541, 525 Main St, Louisville, CO 80027.

Saturday, August 24, 2019 at 8:30 AM. LO Mosse 1857, 2310 Edison St, Brush, CO 80723.

Saturday, September 14, 2019 at 8:00 AM. Alamosa Senior Center, 92 Colorado Ave, Alamosa, CO 81101.

Saturday, November 23, 2019 at 8:30 AM. Platteville Community Complex, 508 Reynolds Ave, Platteville, CO 80651.

You can also sign up to host a Games Manager training course. Follow this link to provide us with a few details about you and your organization, and host a class soon.

The Games Manager mail-in certification exam is no longer available.

Investigator Tips

Each quarter, we include a few tips from our Bingo/Raffle Investigators. They gather a lot of information in the field on where licensees have trouble complying with the law. By sharing this information, we hope that licensees can better serve their customers.

A MESSAGE FROM THE INVESTIGATORS:

Section 24-21-622 (3)(a), C.R.S. states that all money collected or received from the games of bingo....shall be deposited in a special checking or savings account.... What this means is that the money collected from that occasion must be deposited into their bingo account. It does not mean that the starting cash, if it came from a safe held at the bingo hall, must be deposited along with that occasions receipts. As long as our office knows that money in the groups safe came from their bingo account properly by writing a check for the starting bank, and is replenished as needed by a check to draw money out of their segregated account, the organization can hold those funds in the safe as needed without depositing that money per occasion.

As an example:

- A licensee writes a check to the GM, for the starting bank.

- GM cashes check and places the cash in the safe at the hall.

- At the start of the occasion, the GM takes that money out of the safe for the starting bank.

- At the end of the occasion the receipts for sales of all games is deposited into their bingo account.

- The startup money is placed back into the safe for the next occasion.

- If the deposit cuts into the startup money, a check should be written to the GM to replenish the starting bank, held in the safe.

You can access all bingo/raffle laws using our Bingo-Raffles Law Handbook. Please feel free to contact our office with any questions.

|

![]() The information on this page is archived and provided for reference purposes only. It may be outdated or no longer maintained.

The information on this page is archived and provided for reference purposes only. It may be outdated or no longer maintained.